Why Subscription and Recurring Billing Management?

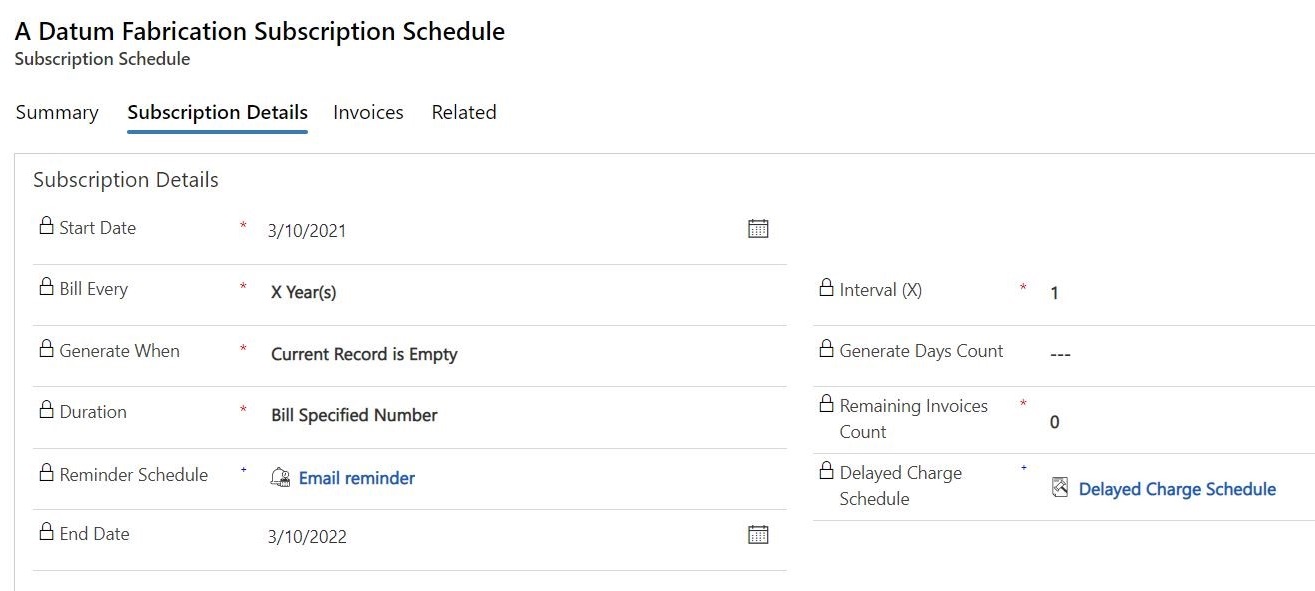

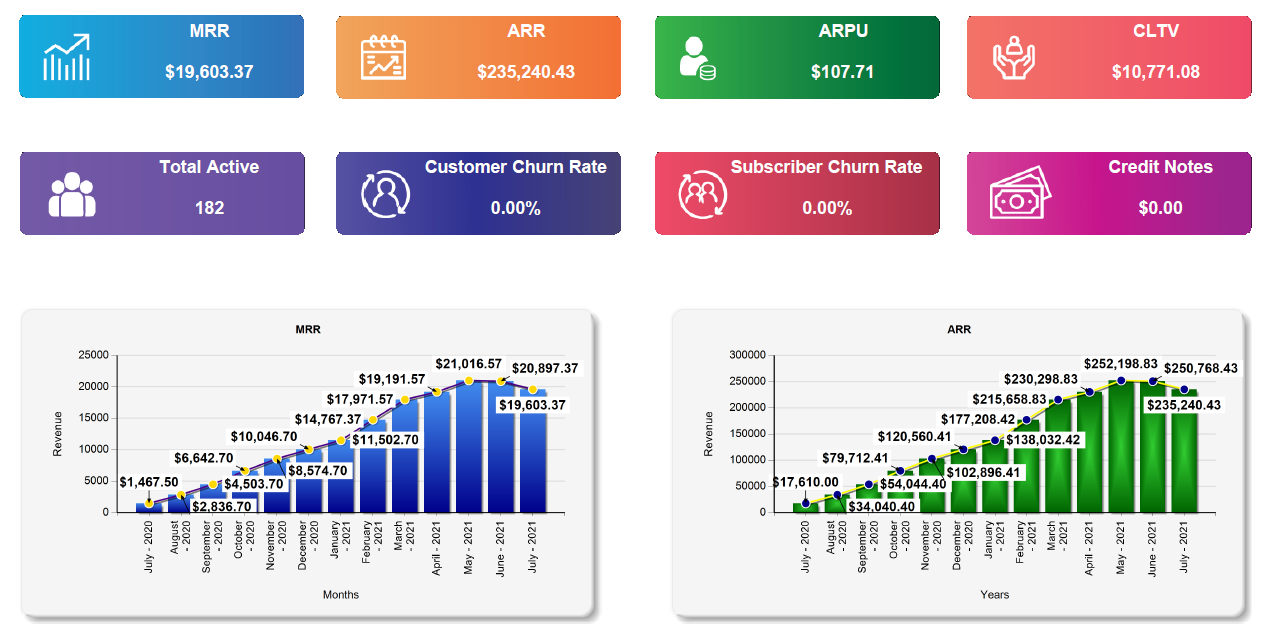

For Dynamics 365 CRM users who run subscription-based businesses, a subscription management solution is essential to manage recurring payments, invoices, and subscriber data easily and accurately. Subscription management in Dynamics 365 CRM requires handling complex billing scenarios, multiple currencies, taxes, and subscription changes. All of this is to make data-driven decisions. And all of these involve a lot of manual work and often lead to errors and inefficiencies. This is where Inogic’s Subscription and Recurring Billing Management App comes into the picture.